[Disclaimer: My Story is in active litigation with State Farm defending, so many details are omitted or obfuscated to protect the parties until adjudication. My intention is to share the full story in time.]

Mold was found in a property we were leasing. The toxic variety. In an instant, the course of our lives changed forever. We lost everything. The symptoms can be subtle and non-specific, so if you think you are suffering from toxic mold, start with Surviving Mold. Their site has changed since our event in late 2021, and you’ll have to dig around for the resources on how to handle your possessions and not cross-contaminate yourself, which I can attest is a real issue.

Skipping all the “who struck John” of the situation, the important detail here is that we filed the inevitable lawsuit against the owner to recover our losses. Since State Farm is the owner’s insurer, they stepped in to defend against our claim given they’re the first dollars at risk. That’s where the UNFAIR Act story begins.

I don’t have any evidence to dispute the industry’s assertions on the volume of fraudulently inflated claims; however, from my perspective, it’s turned into an excuse to treat ALL claims as fraud, grinding all claimants, regardless of merit, through a wrenching process. I was surprised by the invasive nature of the standard round of interrogatories (e.g., export ALL your social media activity, details on ALL medical providers over the last 5 years, do you still have access to the same iPhone, etc…) and the absurd legal positioning that comes with them.

Here’s one of many pictures of the “alleged” mold, so I can’t wait to hear the alternate theory. I have this Hollywood-induced courtroom fantasy: “We have to give the jury an alternative to raise reasonable doubt. Let’s call it a coffee stain!”

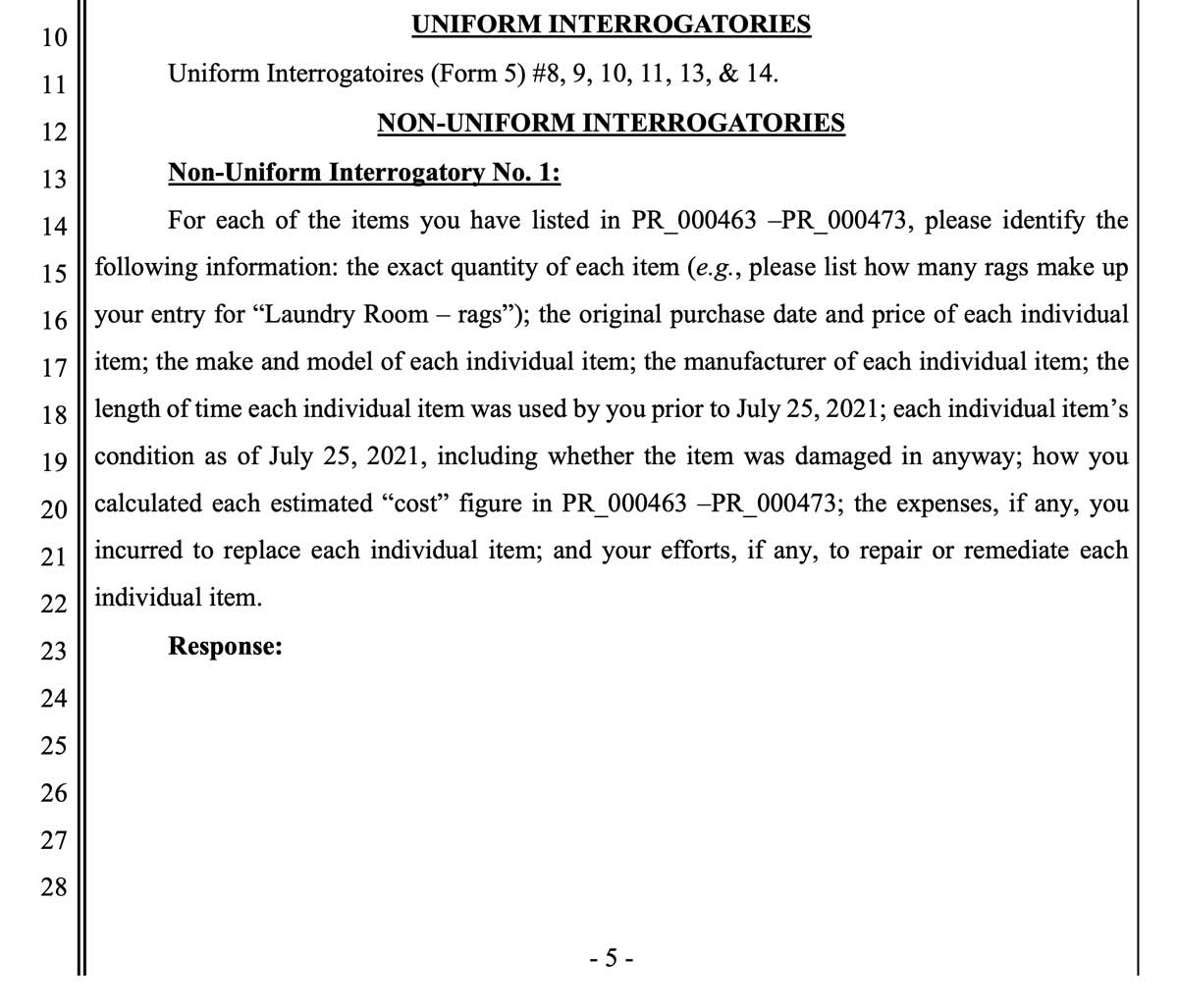

The real gotcha comes into play when you have to tally all the parts of your claim from 20+ years of married life accumulation with 5 kids. That monumental task leads to this little weaponized gem, which I’m sure is effective at stopping many claims dead in their tracks. So brazen! We didn’t submit a claim for ‘Laundry Room – rags’ and they didn’t even bother to customize the boilerplate—just cut, paste, and wipe them away:

Imagine trying to answer this question.

And in 30 days, despite your day job. The only inventory we had was a video I took after donning a HazMat suit and walking through the house with that previously mentioned iPhone. But converting that video to the requested report? Not even close. I suggested the following: “The parties mutually agree on an independent appraiser (a public adjuster) to review the 2 x 4k video inventories (as suggested by State Farm in its own claim documentation processes), purchase receipts, and other evidence to arrive at an independent valuation of the home’s contents. …Both parties agree in advance to be bound by the public adjuster’s finding as final” I proposed to agree to their determination in advance, sight unseen. Seems to me like a reasonable and fair way to get the job done.

No dice. That puts us here:

“…there’s no such legal remedy as “demand[ing] a private adjuster service” – our only claim for legal relief is requesting damages for the loss you incurred. When it comes to personal property, and damages in general, the law provides an injured party should be put in the same position as they were before the injury-producing event. United States Fidelity and Guaranty Co. v. Davis, 3 Ariz.App. 259, 413 P.2d 590 (1966) (plaintiffs were entitled to recover an amount that would put them in the position they were in before they were injured.) “